Introducing the International Fuel Tax Agreement ( IFTA)

The International Fuel Tax Agreement (IFTA) is an agreement between the 48 contiguous U.S. states and 10 Canadian provinces that simplifies the reporting of fuel use by qualifying motor vehicles operating in more than one jurisdiction.

Qualified Motor Vehicle

Your vehicle qualifies for IFTA fuel tax reporting if it meets the following standards:

- Any vehicle with 2 or more axles and a gross weight that exceeds 26,000 pounds (or)

- Any vehicle with 2 axles with a registered weight that exceeds 26,000 pounds (or)

- Any vehicle with 3 or more axles regardless of weight (or)

- Any vehicle used in combination with a gross weight or registered weight exceeding

26,000 pounds.

Visit TruckLogics to generate your Quarterly IFTA report

Why Should You Generate Your IFTA Report

With TruckLogics?

TruckLogics is the best IFTA fuel tax reporting software for quickly and conveniently calculating your IFTA totals

with 100% accuracy.

IFTA Reporting Software - Features

Trip Sheet Entries

Quick Entries

Accurate Fuel Tax Calculation

Bulk Data Upload

GPS Data Upload

IFTA and IRP Reports

Auto Generate Multiple Reports

Record-Keeping

Late Returns

Miles/KM and Gallon/Liter Conversion

Assistance on IFTA Reporting

24*7 US Based Customer Support

What Information is Required to

File Your IFTA Online?

The following fuel tax reporting information is required to complete

your return:

- IFTA license

- Qualified vehicles and fuels

- Total miles (Taxable and Non-Taxable) traveled

per jurisdiction - Total amount of fuel purchased

per jurisdiction - Total amount of fuel consumed per jurisdiction, and

- The amount of tax paid per gallon of fuel

per jurisdiction

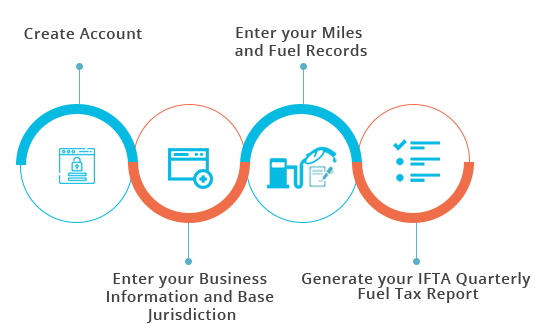

How to Generate Quartely IFTA Fuel Tax Online

What is the penalty for late filing your quarterly

IFTA fuel tax return?

Maximum of state following the penalty for filing your IFTA return late is a flat rate fee of $50 or 10% of the delinquent taxes due and this depends on which amount is greater. Nevada is an exception to the rule because Nevada's penalty for filing late is a $50 flat fee plus 10% of the taxes due.